All Categories

Featured

Table of Contents

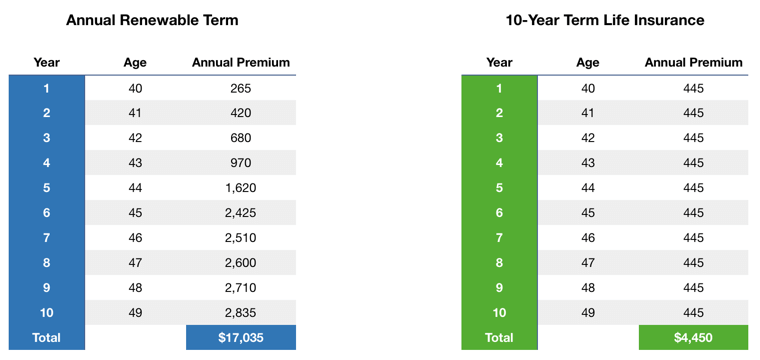

A degree term life insurance coverage plan can give you peace of mind that the people that depend upon you will have a survivor benefit throughout the years that you are intending to sustain them. It's a means to assist look after them in the future, today. A degree term life insurance policy (occasionally called level premium term life insurance) policy provides insurance coverage for a set variety of years (e.g., 10 or 20 years) while keeping the costs repayments the same for the duration of the policy.

With degree term insurance coverage, the expense of the insurance will remain the same (or potentially decrease if returns are paid) over the regard to your policy, generally 10 or 20 years. Unlike irreversible life insurance policy, which never runs out as lengthy as you pay costs, a level term life insurance policy will finish at some factor in the future, typically at the end of the period of your level term.

What is Level Term Life Insurance Meaning? Detailed Insights?

As a result of this, lots of people make use of permanent insurance policy as a steady economic planning tool that can serve numerous demands. You may have the ability to transform some, or all, of your term insurance coverage throughout a set duration, generally the initial ten years of your plan, without requiring to re-qualify for protection even if your health and wellness has transformed.

As it does, you may want to add to your insurance coverage in the future - 10-year level term life insurance. As this takes place, you may desire to eventually decrease your fatality benefit or think about transforming your term insurance to a long-term plan.

Long as you pay your costs, you can rest very easy understanding that your loved ones will get a death advantage if you die throughout the term. Numerous term policies enable you the capability to convert to irreversible insurance policy without having to take another wellness exam. This can permit you to make the most of the added advantages of a permanent plan.

Degree term life insurance policy is just one of the most convenient paths into life insurance policy, we'll discuss the advantages and disadvantages so that you can select a plan to fit your requirements. Degree term life insurance coverage is the most typical and standard form of term life. When you're looking for momentary life insurance policy strategies, degree term life insurance coverage is one path that you can go.

The application procedure for level term life insurance coverage is usually really simple. You'll fill in an application that contains general personal info such as your name, age, and so on in addition to a more comprehensive questionnaire regarding your medical background. Depending on the plan you have an interest in, you might have to take part in a medical examination procedure.

The brief response is no. A level term life insurance policy plan does not develop cash money worth. If you're wanting to have a plan that you're able to withdraw or borrow from, you may explore permanent life insurance policy. Whole life insurance policy plans, for instance, allow you have the convenience of survivor benefit and can accrue money value in time, implying you'll have much more control over your advantages while you live.

What is the Difference with What Does Level Term Life Insurance Mean?

Cyclists are optional provisions added to your plan that can offer you additional advantages and protections. Anything can take place over the course of your life insurance coverage term, and you desire to be prepared for anything.

There are circumstances where these advantages are constructed into your policy, but they can additionally be readily available as a different enhancement that requires extra settlement.

Latest Posts

Best Life Insurance To Cover Funeral Expenses

Burial Plans Life Insurance

Select Advisor Life Insurance