All Categories

Featured

Table of Contents

That normally makes them a more economical choice forever insurance coverage. Some term plans might not maintain the costs and survivor benefit the same in time. You don't wish to wrongly believe you're getting degree term coverage and after that have your survivor benefit adjustment later. Lots of people get life insurance policy protection to help monetarily protect their loved ones in instance of their unanticipated fatality.

Or you might have the option to convert your existing term protection right into an irreversible policy that lasts the remainder of your life. Various life insurance coverage policies have potential advantages and drawbacks, so it's important to understand each prior to you decide to buy a plan.

As long as you pay the costs, your beneficiaries will get the fatality benefit if you die while covered. That claimed, it is essential to note that most plans are contestable for 2 years which implies insurance coverage could be retracted on fatality, ought to a misstatement be discovered in the app. Plans that are not contestable typically have a graded survivor benefit.

Premiums are usually less than whole life plans. With a level term policy, you can choose your insurance coverage quantity and the policy length. You're not locked into a contract for the rest of your life. Throughout your plan, you never ever have to stress concerning the premium or death benefit quantities changing.

And you can't squander your policy during its term, so you won't receive any kind of economic advantage from your previous coverage. Just like other kinds of life insurance coverage, the expense of a level term policy relies on your age, insurance coverage needs, work, way of living and health. Usually, you'll discover more budget friendly protection if you're younger, healthier and less dangerous to insure.

Effective What Is Level Term Life Insurance

Given that level term costs stay the very same for the period of coverage, you'll know exactly just how much you'll pay each time. Degree term insurance coverage likewise has some flexibility, enabling you to customize your plan with additional functions.

You may have to satisfy specific conditions and qualifications for your insurance firm to enact this cyclist. Additionally, there may be a waiting duration of as much as six months prior to working. There likewise might be an age or time limitation on the protection. You can add a child motorcyclist to your life insurance policy policy so it likewise covers your children.

The death benefit is usually smaller sized, and protection typically lasts until your kid turns 18 or 25. This cyclist might be a more cost-effective means to aid ensure your youngsters are covered as motorcyclists can typically cover several dependents simultaneously. When your kid ages out of this protection, it may be feasible to convert the rider into a new plan.

When comparing term versus irreversible life insurance policy. what is voluntary term life insurance, it is very important to keep in mind there are a couple of various types. One of the most common type of permanent life insurance is whole life insurance, but it has some essential distinctions contrasted to level term protection. Right here's a basic introduction of what to consider when comparing term vs.

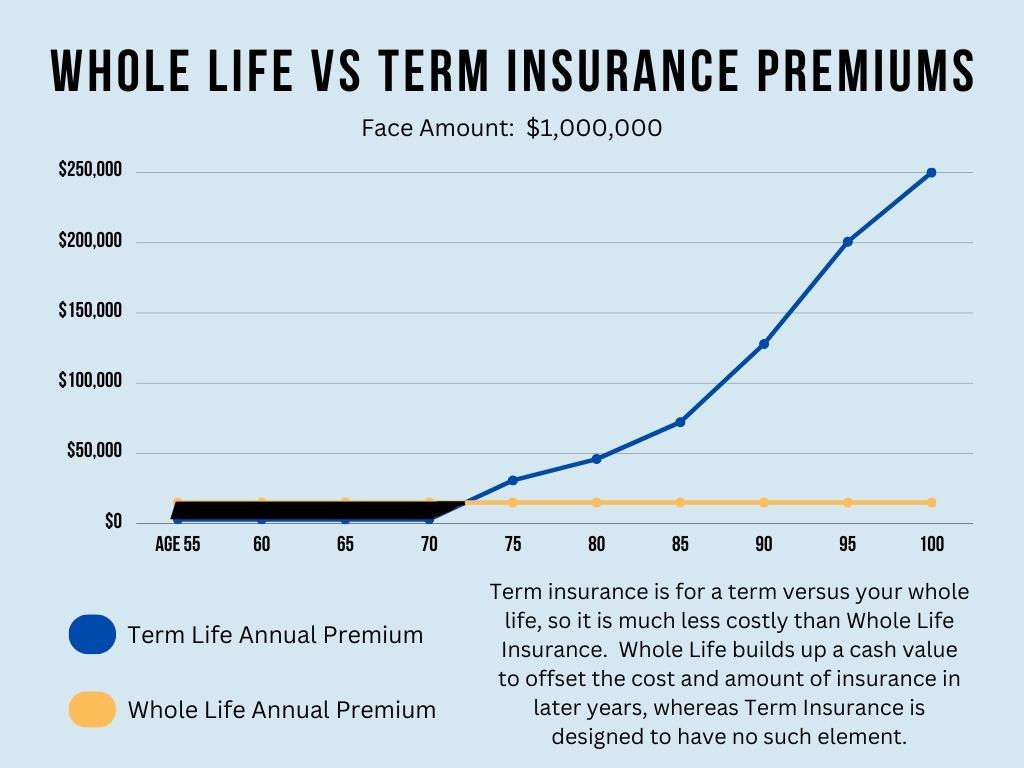

Entire life insurance coverage lasts permanently, while term insurance coverage lasts for a specific period. The premiums for term life insurance are normally less than entire life coverage. With both, the premiums stay the exact same for the period of the plan. Entire life insurance has a money worth element, where a portion of the premium may expand tax-deferred for future needs.

One of the main features of degree term insurance coverage is that your premiums and your fatality advantage don't alter. You may have coverage that begins with a death benefit of $10,000, which might cover a home mortgage, and then each year, the fatality benefit will certainly reduce by a set amount or percent.

Due to this, it's typically a more economical type of level term insurance coverage., however it might not be enough life insurance for your demands.

After deciding on a plan, finish the application. If you're authorized, sign the documents and pay your first costs.

Flexible Guaranteed Issue Term Life Insurance

You may want to upgrade your recipient details if you've had any kind of significant life changes, such as a marital relationship, birth or divorce. Life insurance coverage can sometimes feel difficult.

No, degree term life insurance policy does not have cash value. Some life insurance coverage policies have a financial investment function that permits you to develop money value with time. A part of your costs repayments is alloted and can earn passion gradually, which expands tax-deferred during the life of your insurance coverage.

You have some alternatives if you still want some life insurance protection. You can: If you're 65 and your protection has run out, for instance, you might desire to buy a brand-new 10-year degree term life insurance policy.

Dependable Does Term Life Insurance Cover Accidental Death

You may have the ability to convert your term insurance coverage into a whole life policy that will certainly last for the rest of your life. Lots of kinds of level term policies are convertible. That suggests, at the end of your insurance coverage, you can transform some or all of your plan to entire life insurance coverage.

Degree term life insurance is a plan that lasts a set term normally in between 10 and three decades and features a level fatality advantage and degree premiums that stay the very same for the entire time the policy is in impact. This implies you'll understand specifically just how much your settlements are and when you'll need to make them, allowing you to budget appropriately.

Level term can be a fantastic option if you're aiming to acquire life insurance policy coverage for the very first time. According to LIMRA's 2023 Insurance Measure Research, 30% of all adults in the U.S. demand life insurance policy and don't have any type of kind of policy yet. Degree term life is foreseeable and inexpensive, which makes it one of one of the most prominent kinds of life insurance coverage.

Latest Posts

Best Life Insurance To Cover Funeral Expenses

Burial Plans Life Insurance

Select Advisor Life Insurance